Embark on a journey towards financial freedom with the essential guide on How to Achieve Financial Freedom: 5 Principles for Building Wealth. Discover the key strategies to secure your financial future and pave the way for lasting prosperity.

Delve into the core principles and practical tips that will empower you to take control of your finances and build a solid foundation for wealth creation.

Principles of Financial Freedom

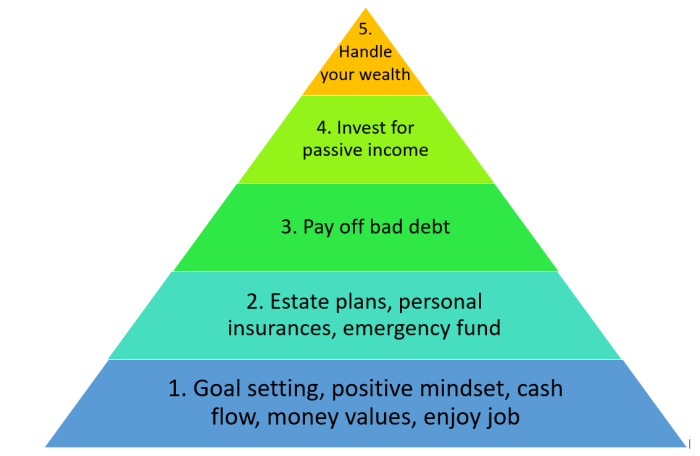

Financial freedom in the context of wealth building refers to the ability to make choices about how to use your money without being constrained by financial obligations. It means having enough resources to cover your expenses, achieve your goals, and live the life you desire without worrying about money.

Setting clear financial goals is crucial for achieving financial freedom. These goals act as a roadmap, guiding your financial decisions and helping you stay focused on your objectives. Whether it’s saving for retirement, buying a home, or starting a business, having specific, measurable goals will keep you motivated and accountable.

The Role of Creating a Budget

Creating a budget is a fundamental step in building wealth. It allows you to track your income and expenses, identify areas where you can cut costs, and allocate money towards your financial goals. By sticking to a budget, you can avoid overspending, build savings, and gradually increase your wealth over time.

- Track your income and expenses: Keep a record of all your sources of income and where your money is going each month.

- Identify spending patterns: Look for trends in your expenses and find areas where you can reduce unnecessary costs.

- Allocate money wisely: Prioritize your financial goals and allocate funds towards savings, investments, and debt repayment.

By creating and following a budget, you can take control of your finances and make informed decisions that will lead to long-term financial stability.

The Significance of Investing Wisely

Investing wisely is key to building wealth and achieving financial freedom. By putting your money to work in assets that have the potential to grow over time, you can increase your net worth and secure your financial future.

- Start early and stay consistent: The power of compounding allows your investments to grow exponentially over time, so the earlier you start investing, the better.

- Diversify your investments: Spread your money across different asset classes to reduce risk and maximize returns.

- Educate yourself: Understand the basics of investing, research different investment options, and seek professional advice when needed.

Investing wisely requires patience, discipline, and a long-term perspective. By making informed decisions and staying committed to your investment strategy, you can build wealth steadily and work towards financial freedom.

Budgeting Strategies for Wealth Building

Budgeting is a crucial aspect of building wealth as it helps individuals track their income and expenses, prioritize savings, and reduce unnecessary spending. Implementing effective budgeting strategies can significantly contribute to achieving financial freedom.

Different Budgeting Methods

- Zero-Based Budgeting: This method requires assigning every dollar a specific purpose, ensuring that income minus expenses equals zero. It helps individuals track where their money is going and avoid overspending.

- 50/30/20 Rule: With this rule, 50% of income goes towards needs, 30% towards wants, and 20% towards savings and debt repayment. It provides a simple guideline for allocating income effectively.

- Envelope System: In this method, individuals allocate cash into different envelopes for various categories such as groceries, entertainment, and transportation. Once the envelope is empty, they stop spending in that category, promoting better budget management.

Tracking Expenses and Cutting Costs

- Keep detailed records of expenses to identify spending patterns and areas where costs can be reduced.

- Review monthly expenses regularly to find opportunities for saving, such as eliminating subscriptions or negotiating lower bills.

- Consider using budgeting apps or spreadsheets to track expenses more efficiently and categorize spending.

Automating Savings and Investments

- Set up automatic transfers from your checking account to savings or investment accounts to ensure consistent contributions.

- Take advantage of employer-sponsored retirement plans that automatically deduct contributions from your paycheck.

- Consider automated investing platforms that help you invest regularly without manual intervention.

Prioritizing Debt Repayment Within a Budget

- Allocate a portion of your budget towards paying off high-interest debts to reduce overall interest payments.

- Consider using the debt snowball or debt avalanche method to tackle multiple debts systematically.

- Prioritize debts with the highest interest rates first to save money in the long run.

Investment and Wealth Building

Investing is a crucial aspect of building wealth and achieving financial freedom. By putting your money to work, you have the potential to grow your wealth over time. One of the key concepts that make investing powerful is compound interest.

The Power of Compound Interest

Compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods. This means that your money can grow exponentially over time, as you earn interest on both your initial investment and the interest it generates.

Compound interest is often referred to as the “eighth wonder of the world” – Albert Einstein

Comparison of Investment Options

When it comes to investing, there are various options to consider such as stocks, bonds, real estate, and retirement accounts. Each of these investment vehicles has its own risk and return profile, and it’s important to diversify your portfolio to minimize risk.

- Stocks: Investing in stocks gives you ownership in a company and the potential for high returns, but comes with higher volatility.

- Bonds: Bonds are debt securities issued by companies or governments, providing fixed interest payments but with lower returns compared to stocks.

- Real Estate: Real estate investment involves buying property to generate rental income or capital appreciation over time.

- Retirement Accounts: Retirement accounts like 401(k) or IRA offer tax advantages and long-term savings for retirement.

Importance of Diversification

Diversification is key to reducing risk in your investment portfolio. By spreading your investments across different asset classes and industries, you can protect your wealth from volatility in any single investment.

Risk Management and Minimizing Losses

Implementing risk management strategies is essential to safeguard your investment portfolio. This may include setting stop-loss orders, conducting thorough research before investing, and avoiding emotional decision-making during market fluctuations.

Ending Remarks

As we conclude our exploration of How to Achieve Financial Freedom: 5 Principles for Building Wealth, remember that the path to financial independence is within your reach. By implementing these principles and strategies, you can unlock a future of financial stability and abundance.